AUD/USD: Momentum Cools After Soft Jobs Data

Australia’s latest labour-market figures have tempered some of the enthusiasm behind AUD/USD’s recent rally. After several strong weeks driven largely by shifting interest-rate expectations, the softer employment data provided a timely reminder that momentum requires consistent economic support. As the pair moves toward a key resistance area, traders are becoming more selective about chasing additional upside.

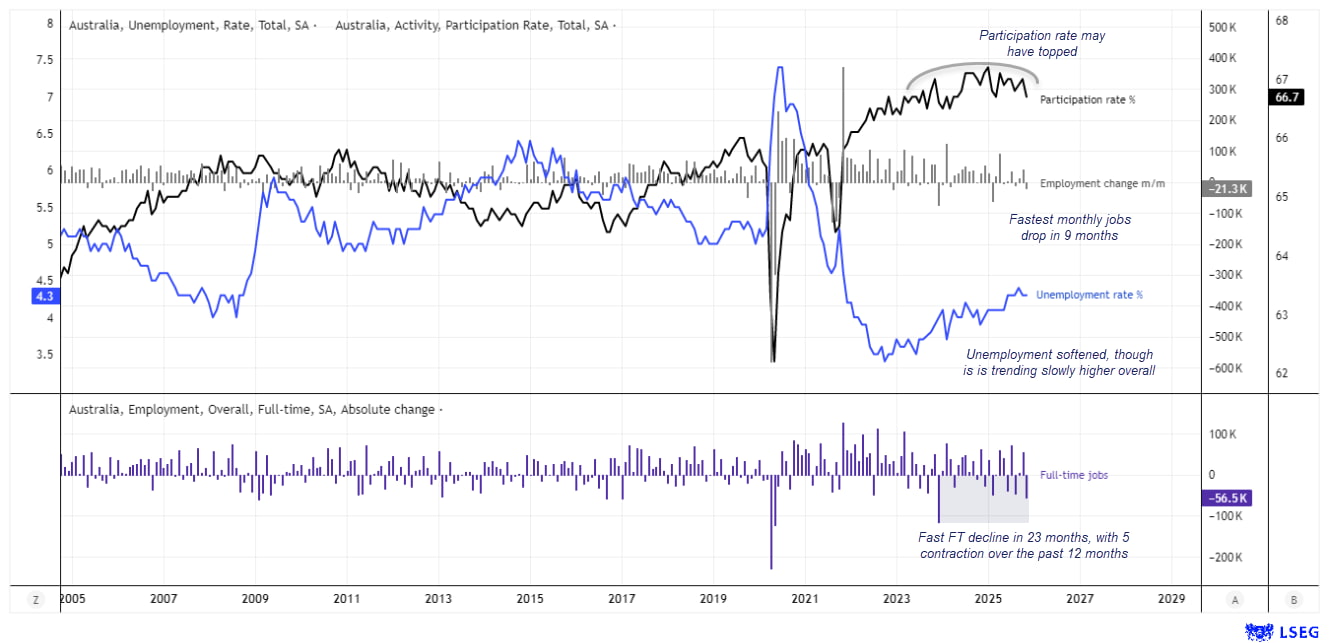

Australian Labour Market Snapshot

- The unemployment rate remained at 4.3%, sitting just below its recent four-year peak of 4.5%

- Total employment fell by 21.3k in November — the sharpest monthly decline in nine months

- Full-time positions dropped by 56.6k, marking the largest contraction in nearly two years

- The participation rate eased to 66.7%, an eight-month low

Although the labour market is not weakening dramatically, the decline in full-time jobs is notable. Should December also print negative numbers, Australia could record its first back-to-back fall in full-time employment since the pandemic — a development likely to weigh on the Reserve Bank of Australia's (RBA) assessment of labour-market tightness.

RBA Outlook: What the Data Means for Policy

The RBA is likely to view the labour market as slightly less tight than earlier in the quarter, yet still resilient enough to keep further policy tightening on the table. Whether the central bank follows through with a rate increase at the February meeting will depend heavily on upcoming inflation data and early-2025 employment figures.

A meaningful reduction in the probability of a February hike would require:

- A noticeably weaker January employment report

- A cooler-than-expected Q4 CPI print on January 26

Even if a hike occurs, the current landscape does not suggest the beginning of a rapid tightening cycle. Instead, the RBA may prefer a cautious stance while monitoring how labour-market conditions evolve into the first quarter.

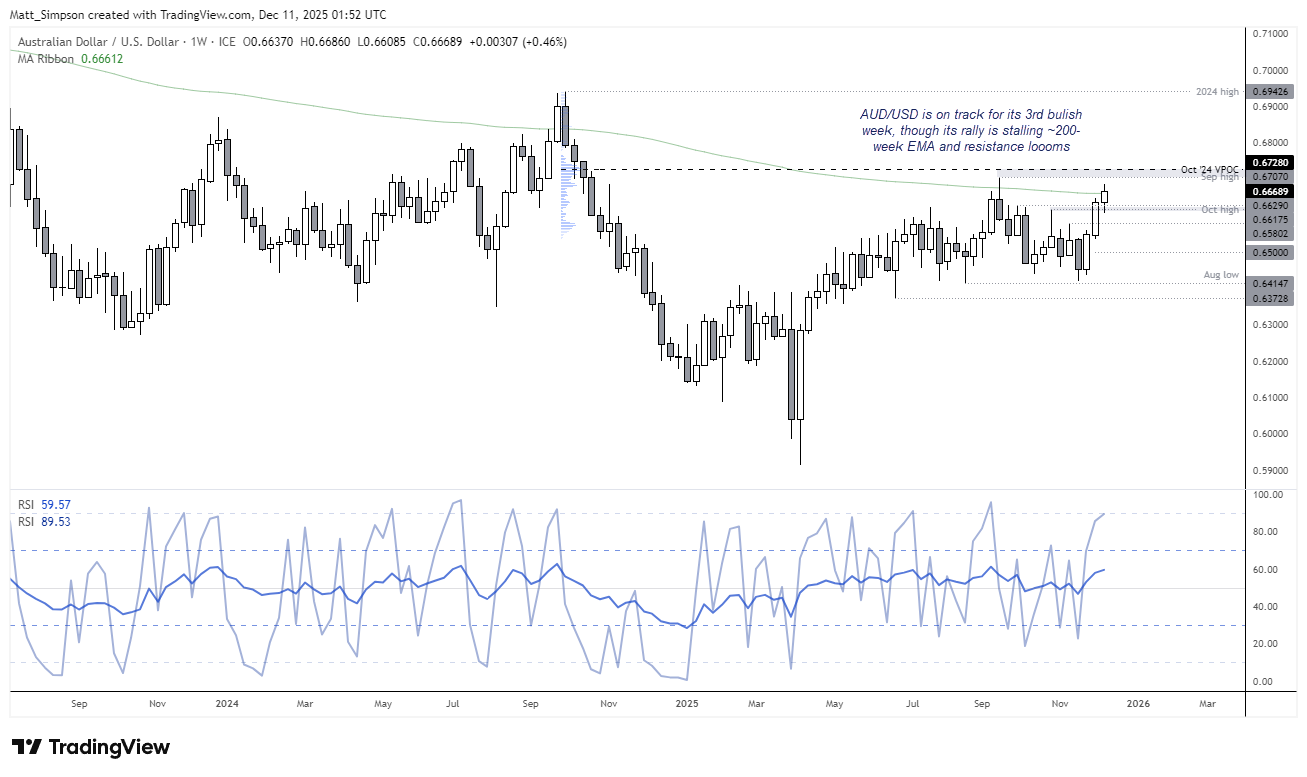

AUD/USD Technical Outlook

Momentum Slows as AUD/USD Approaches Key Resistance

The Australian dollar is pacing toward its third consecutive bullish week, but upside momentum is becoming stretched. Weekly RSI(2) has moved above 90 — a level that historically signals fatigue rather than immediate reversal. Price is also closing in on the September high, an area where several traders may consider adjusting exposure.

Seasonally, December tends to favour AUD strength, yet the maturing nature of the current rally suggests the next leg higher could be slower and more selective.

Daily Chart: Levels to Watch

On the daily timeframe, price action has stalled around a weekly VPOC at 0.6670 and the monthly R2 pivot near 0.6680. Market participants appear to be consolidating rather than reversing, suggesting demand remains present beneath current levels.

Should a pullback develop, it may be limited. A move toward the October high would likely be perceived as a healthy retracement rather than a shift in trend. A clean break above the September high, on the other hand, would expose the October 2024 VPOC and open the door for a move toward the 0.67 region.

Conclusion

The Australian dollar’s advance has met its first real test as employment data softens. While this does not shift the broader trend on its own, it does slow the pace of bullish momentum. With major resistance levels just overhead and important macro data approaching, AUD/USD traders may favour a more tactical approach in the sessions ahead.

.png)

.png)